The Gulf of Mexico is home to approximately 98% of the country’s offshore oil and gas production. It is the most developed oil and gas infrastructure in the country, and according to the US Department of the Interior’s (DOI’s) Bureau of Ocean Energy Management (BOEM), it contains the highest levels of undiscovered, technically recoverable oil and gas resources of any region in the US. The leasing of these offshore areas for oil and gas extraction and production is governed primarily by two laws: the Outer Continental Shelf Lands Act, which broadly controls oil and gas leasing throughout the U.S. outer continental shelf; and the Gulf of Mexico Energy Security Act of 2006, which relates specifically to leasing in the Gulf.

Geography

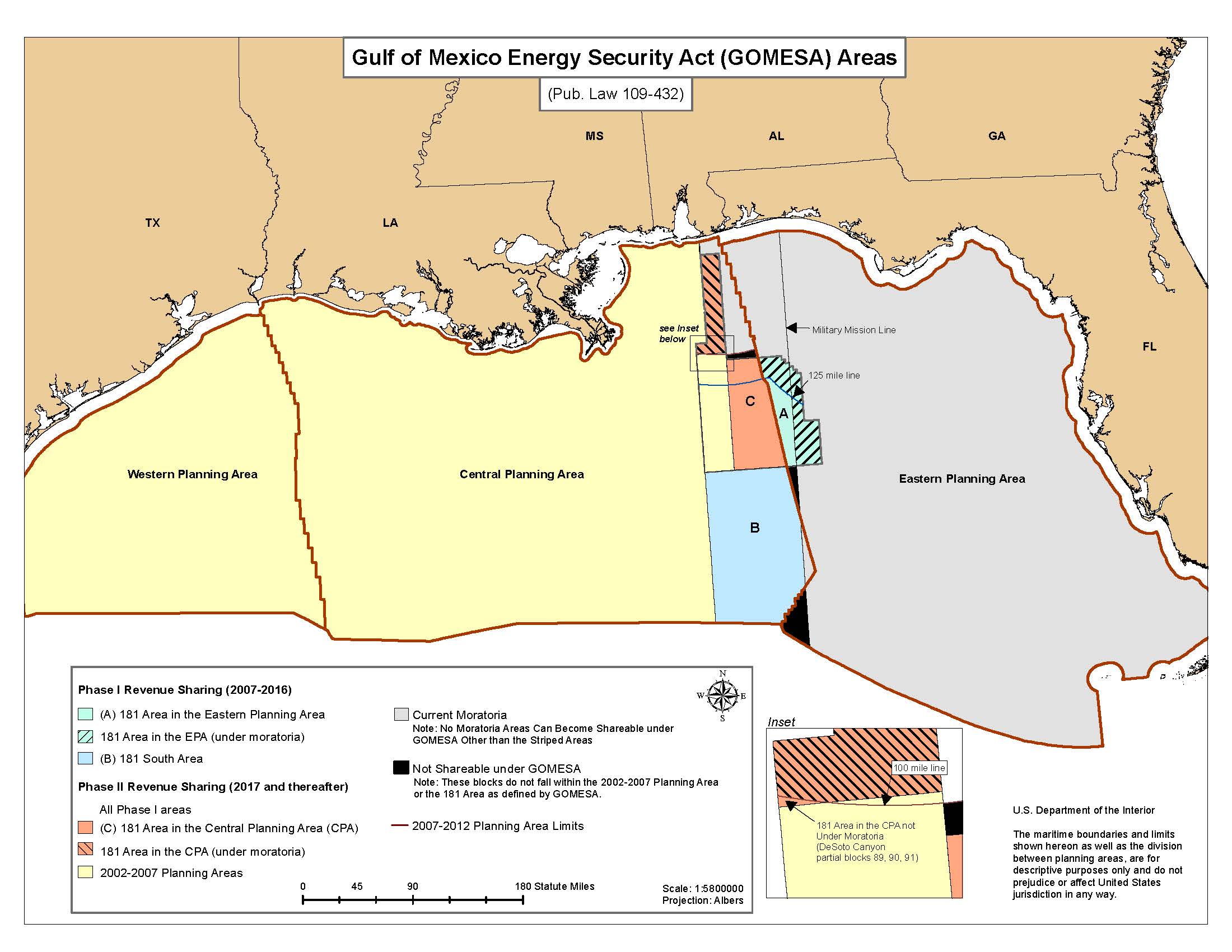

BOEM divides the Gulf into three planning areas: Eastern, Central, and Western. Most of the oil and gas development has taken place in the Central and Western Gulf planning areas because there are more oil and gas resources in those areas (as compared with the Eastern Gulf). Within the three planning areas, only four states are considered “Gulf Producing States” for the purposes of GOMESA: TX, LA, MS, and AL.

What does GOMESA do?

Revenue Sharing

On December 20, 2006, the Gulf of Mexico Energy Security Act (GOMESA) was signed into law as part of The Tax Relief and Health Care Act of 2006. GOMESA created a revenue-sharing model for oil and gas producing states in the Gulf of Mexico. Under this act, Alabama, Louisiana, Mississippi, and Texas (producing states) receive a portion of the revenue generated from oil and gas production, such as leasing revenues offshore in the Gulf of Mexico. The funds are intended to mitigate the demands placed on infrastructure and natural resources associated with oil and gas production on the Gulf Coast states that host that energy production.

In Louisiana, GOMESA provides a consistent source of funding to address the land loss crisis. To date, Louisiana officials have made clear commitments to using the state’s share of GOMESA funding for implementing the Coastal Master Plan. https://coastal.la.gov/our-plan/ Louisiana voters have constitutionally dedicated all future revenues from GOMESA to the Coastal Trust Fund to be used exclusively for restoration and protection activities. In the 2023 fiscal year, Louisiana received a total of $156,161,553 which was divided between the state and the coastal parishes.

GOMESA also directs a portion of revenue to the Land and Water Conservation Fund, which invests earnings from offshore oil and gas leasing to safeguard natural areas, water resources, cultural heritage and provide recreation opportunities across America.

In 2017, Phase II of GOMESA expanded the oil and gas leases from which revenue sharing was required. This resulted in increased revenues for the Gulf Coast states, including the State of Louisiana. It also increased the revenue sharing cap of $500 million per year for the four Gulf producing States to $650 million for the years 2020 and 2021.

Budget proposals by President Trump in 2017 and President Obama in 2016 attempted to redirect funds from GOMESA away from the Gulf States and back into more general funds. Continued advocacy from local elected officials, NGOs and businesses in the Gulf has successfully prevented such actions to date.

Find GOMESA Revenue-Sharing Allocations and other statistical information here.

Eastern Gulf Moratorium

GOMESA also established the Eastern Gulf Moratorium, banning oil and gas leasing within 125 miles off the Florida coastline in the Eastern Planning Area, and a portion of the Central Planning Area, until the year 2022. GOMESA’s leasing moratorium expired in June 2022

Although the GOMESA moratorium has expired, this area was additionally withdrawn from leasing through June 30, 2032, by the Trump Administration, using authority under Section 12(a) of the OCSLA (43 U.S.C. §1341(a)).Access to Acreage for Leasing

With the passage of GOMESA, 8.3 million acres in the Central and Eastern Gulf of Mexico Planning areas were offered for oil and gas leasing through lease sales, which occurred in 2007, 2008, and 2009.

Points of Contact

-

- Department of Energy and Natural Resources Director of Federal Affairs, Neal McMillin, neal.mcmillin@la.gov

- MRD Contact

- Restore the Mississippi River Delta contact, Lauren Bourg, State Policy Committee Chair: lauren.bourg@audubon.org